U.K Banks Are Slashing Savers Deposit Rates

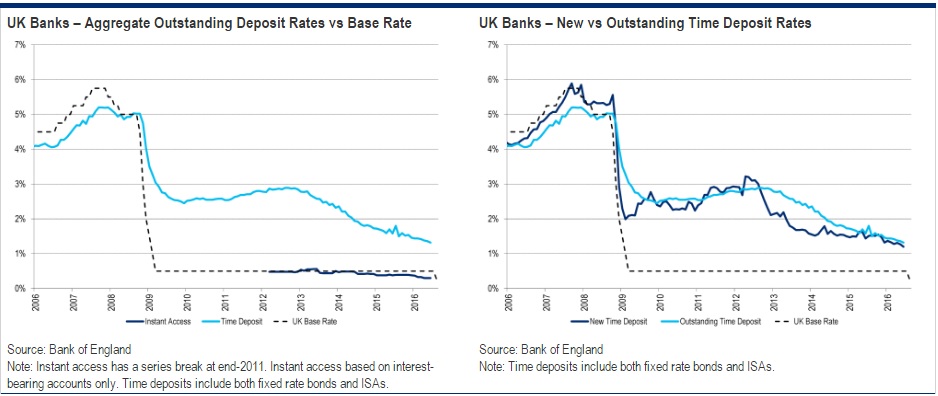

The Bank of England's move to cut benchmark interest rates last month has inflicted an earnings-headache for millions of U.K. savers as British banks slash rates across their retail portfolios. With the average rate on variable savings accounts now just 0.25 percent among major lenders, according to data from Citigroup Inc., British savers are earning less than inflation — which stood at 0.6 percent for July — amid a flurry of lender rate cuts across savings accounts, cash ISAs, and fixed-time deposits.

- Here's a partial run-down of the major banks to have announced cuts to their savings in July and August:

The rate on Santander UK's famous 1-2-3 current account will drop from 3 percent to 1.5 percent, on balances up to 20,000 pounds ($26,660) from November. - Barclays Plc cut its rate on its flagship Everyday Saver account, which houses the majority of the lender's savings deposits, to a flat rate of 0.25 percent from August and this is set to fall further to just 0.05 percent on all balances from December.

- HSBC Holdings Plc is slashing the rate on its Easy Access ISAs from 1.30 percent to 0.90 percent from Sept. 29 while bonus rates on the Online Bonus Saver — as a reward for not making a withdrawal — are being cut to 0.15-0.25 percent in the second year, from 0.25-0.50 percent.

- Lloyds Banking Group and Halifax have cut the rate on the Easy Saver account by 10 basis points (bps) to 0.25 percent.

- From the end of October, Royal Bank of Scotland Group Plc's flagship Natwest Instant Saver account will offer a 0.01 percent rate of interest.

- Finally, TSB Banking Group Plc and Virgin Money Holdings UK Plc have also announced rate cuts with the former's fixed-rate accounts lower by 25 bps, and the latter's easy-access variable savings products cut by 20-26 bps.

Banks are seeking to cut their liability costs as returns on their assets fall further — in tandem with the BOE's August rate cut and U.K. government bond yields at record lows — all in a bid to stabilize their earnings.

The impact of low rates for banks hinges on the extent to which they can reprice loans, deposits and other liabilities, as well as their ability to generate more fees and commissions, and whether they can grow the lending book. As a result, banks need to cut savings rates to protect their ability to generate profits through what's known as the net interest margin.

Savings-rates, therefore, could fall further in the next few months as more banks seek to dodge the low-rate bullet, analysts say.

These deposit-rate cuts "should support net interest margins in the third and fourth quarter, which helps to explain why most of the banks are confident that they can maintain existing margins in the near-term", Citi analysts, led by Andrew Coombs, wrote in a report last week, even though lenders, with a high proportion of floating-rate loans, are set to earn less on their mortgage books.

This view concurs with David Lock at Deutsche Bank AG, who wrote in a report on Monday that the Bank of England's 25 bps rate cut should "initially" help boost earnings by 2bps, citing the fact that a higher proportion of deposits are in floating-rate format compared with loans, while loan exposures are bigger than deposits, providing a short-term earnings tail-wind.

"But for the sector overall this [savings-rate-cut] benefit will begin to fade, we suspect, during mid-2017 as customers remortgage onto cheaper products and competition increases," the Deutsche analysts write.

Given structurally low revenue-pools before the August cut, and weak economic growth constraining credit-volume growth, U.K. banks will see margins come under pressure next year amid diminished flexibility to cut deposit rates further, according to Citi and Deutsche Bank.

The question is to what extent the latest policy-rate cut will further shake up U.K. retail banking. New technology and challenger banks have crimped traditional lenders' firepower to increase fees in retail banking, and to reprice asset yields higher, in tandem with rising liability costs. What's more, the Competition and Markets Authority has recently concluded that the U.K.'s unique free-if-in-credit (FICC) current account model shouldn't be abolished, meaning banks won't be able to offset lower interest rates with higher charges for services.

The question, say the Citi analysts, is how sustainable the latter model is given rising liability costs, though imposing deposit charges on corporate clients look more likely, they say — with RBS last month saying some of its biggest trading clients must pay interest on collateral.

If lenders can't cut their retail savings rates further, the latter trend could intensify, or bankers, where possible, might hike rates on new lending business to offset margin pressure.

Original article by; Sid Verma

Bloomberg.com, Here's How and Why U.K. Banks Are Slashing Savers' Deposit Rates

September 5, 2016 — 1:23 PM CEST