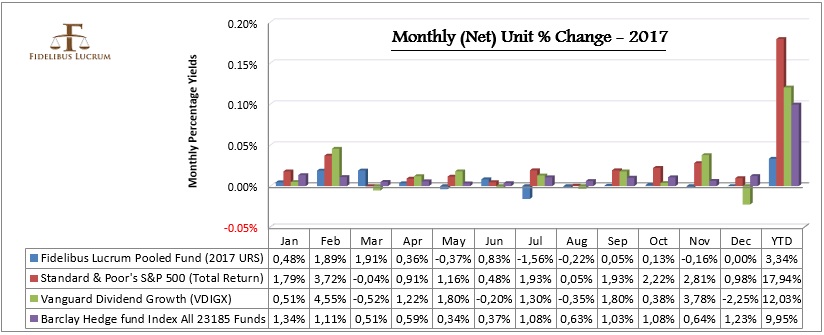

"Pooled Fund (2017 URS)" 2nd Year 3.34% (net) Gain.

Realizing 3.34% (net) yield, achieving consistent performances, Fidelibus Lucrum is delighted to announce results of "Pooled Fund (2017 URS)".

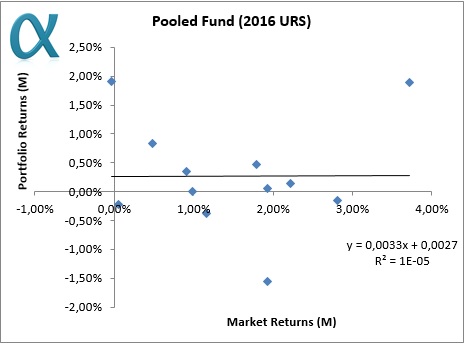

2017 proved to be a difficult year to produce any kind of extraordinary alpha as the markets entered a perpetual uptick with extremely low volatility and absolutely no cyclicality. The fund was mostly in cash with a very low participation rate (see below) and the small gains were won at the beginning of the year.

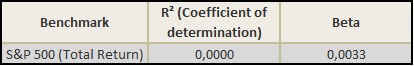

Fidelibus Lucrum our model was developed to outperform our peers equally in in down markets as well as in up markets with extremely low volatility risk in all market environments throughout the year.

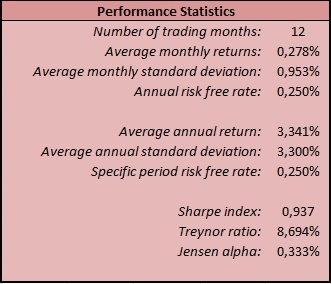

Understanding The Statistics ?

Trading Statistics

84 Total trades, averaging 75.00% profitable trades.

10.75 Average days in trades.

98 (65.77%) Winning v 51 (34.23%) Losing days.

33.33% Bullish v 1.28% Neutral v 65.38% Bearish trades (of which 1.28% were hedging).

7 Profitable months out of 11 (See data above).

3.34% Year end gains (3.21% using the Unit valuation accounting system (time weighted return).

Account net lick % used, Max 51.20% v Min 0.00%

Annual cash participation 10.55%

Understanding The Statistics ?

For more details register on the sites "Login Form" to obtain access to fund literature.

The Manager, Fidelibus Lucrum, Pooled Investment Club.

The Manager, Fidelibus Lucrum, Pooled Investment Club.

31 December 2017. 20.11 Eastern.